Are you thinking of selling your business or looking for a potential new investor to your business? Then it is very important for you to evaluate the economic worth your your business - in other words, you need to do valuation of the business.

Of course, valuation of a business is absolutely not a cakewalk. It is too complicated to valuate various number of factors. There are plenty of ways to accurately value the business.

Whether you might have decided to hire a professional or not, it is ultimately important for you to understand the process of valuation of your business. At least this would help you to know under which process you are going through and reduce the chances of getting trap.

.jpg)

What is a Business Valuation?

Business valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business.

Wikipedia

When Do People Usually Do Business Valuation?

There are various reasons, purposes and circumstances that a business needs to be valuated. These includes;

- Tax Assessments - Valuation of a business is important for the tax reporting. As it determines the fair market value of the business.

- Divorce Settlements - For the divorce cases, it includes the division of the shares and assets . So, business valuation determines the shares for each party.

- Business Analysis - To determine the long term health and the succeeding value of the business, you may require business valuation.

- Basic Book Keeping & Accounting - You can calculate or valuate the economic value of the business with the basic book keeping and accounting. Without these, it is too complex for business valuation.

- Distressed Firms - To sell a distressed firm or sick company, it it essential to determine the valuation of the business.

- Mergers and Acquisitions - The business valuation is indeed essential for the merger and acquisition transaction.

- Financial Reporting - While preparing the financial reporting for the companies and firms, it is necessary to keep a record on the business valuation accounting standards.

This being said, we use various business valuation methods for the various types of businesses. We can evaluate the business value depending on the size of your business, the industry of your business, location of the business, and other factors

6 Main Methods of Business Valuation

Having said that, let's get into the various types of business valuation methods being followed in today's market.

Remember that for various circumstances an purposes, one approach may be more beneficial than the other. Anyhow, you will need a help of a business consultant to get the accurate value of your business.

1. Asset Based Business Valuation Approach

Firstly, the asset based business valuation approach is the most common approach to determine the value of your business. Based on you business balance sheet, the business's total net value minus the value of it's total liabilities (including the tangible and intangible things) determines the value of your business.

Asset Based Value Formula = Business's Total Net Value (Assets) - Total Liabilities Value

Likewise, we can do the asset based valuation approach in two ways namely : Book Value and Liquidation Value

BOOK VALUE APPROACH

When you are looking forward to continue the business and not sell any of your assets immediately, then you should go for the going concern or book value approach for your business valuation.

Book Value Formula = Total Assets - Total Liabilities

LIQUIDATION VALUE APPROACH

In contrast, liquidation approach is ultimately for the urgency situation. This means that the business is completely closed and the assets will be sold immediately.

This type of business valuation approach lowers your business value from the fair market value.

Liquidation Value Formula = Liquidation Value of Assets - Book Value of Liabilities

2. Discounted Cashflow Approach

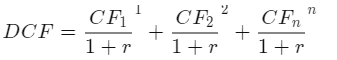

The Discounted Cashflow Method is otherwise known as the Income Approach. In this method, you can estimate the current value of a business depending on the projected future cashflows in the adjusted time value of money.

From the "explicit" forecast period along with a continuing or terminal value, the cash flow stream is made.

where:

CF = The cash flow for the given year.

CF1 is for year one, CF2 is for year two, CFn is for additional years

r = The discount rate

3. Market Value Valuation Approach

Next, then the market value valuation approach is more or less like a subjective approach to determine the value of your business.

For instance, in this method, the value of your business is determined based upon the other similar business's market value. This method differs based on the size of your business, the industry of your business and the location of your business.

For small businesses the valuation of your business can be taken for negotiation from the investors.

Subsequently, market value valuation approach is the best initial preliminary approach to determine the worth of your business. Anyhow, you must consider other valuation methods to have good negotiation.

4. ROI Based Valuation Approach

ROI (Return On Investment) based valuation approach determines the value of your business based on your company's profit and the ROI that which your buyer can potentially make by buying your business.

5. Earning Valuation Approach

On the other hand, earning valuation method determines the value of your business based on the future annual ROI, cashflow and expected value.

Unlike the other approaches, this method works best for stable business. This method estimates the future probability of the profitability.

6. Multiples of Valuation Approach

Finally, similar to the earning valuation method, this multiples of valuation approach determines the profitability of buying the business in the future scope.

This method is also known as "time revenue method." Based on the current revenue, this method evaluates the multiples of the value in the future.

Bottom Line

On the whole, valuation of a business is a complicated one. All the methods of business valuation are unique and important in it's own way.

Overall, you cannot decide only one method of business valuation for valuing your business.

In the end, as we discussed earlier, it is better to hire a professional who would give you a detailed and objective evaluation of your company.